How can finance be leveraged to drive investment in building retrofit work?

Highlights

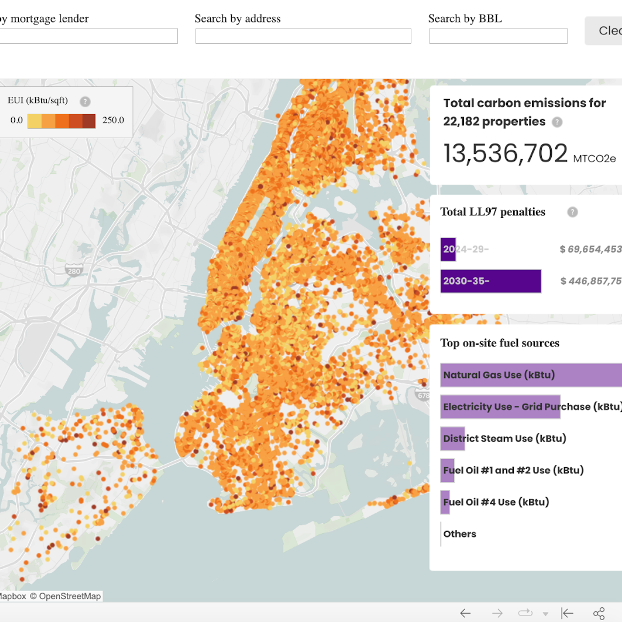

- New data tool brings together building energy data with mortgage lienholder information.

- Disclosing “financed carbon emissions”—or Scope 3 emissions—by banks and financial institutions is critical for investors who seek to understand climate risk in their portfolios.

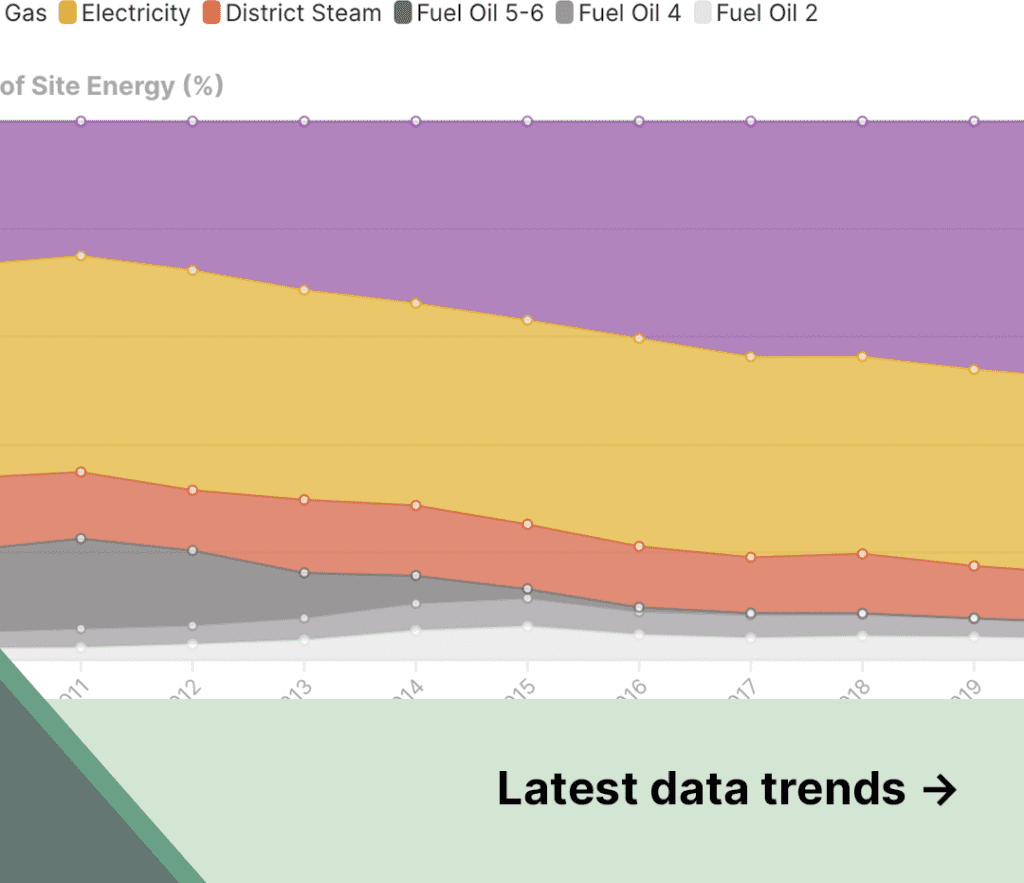

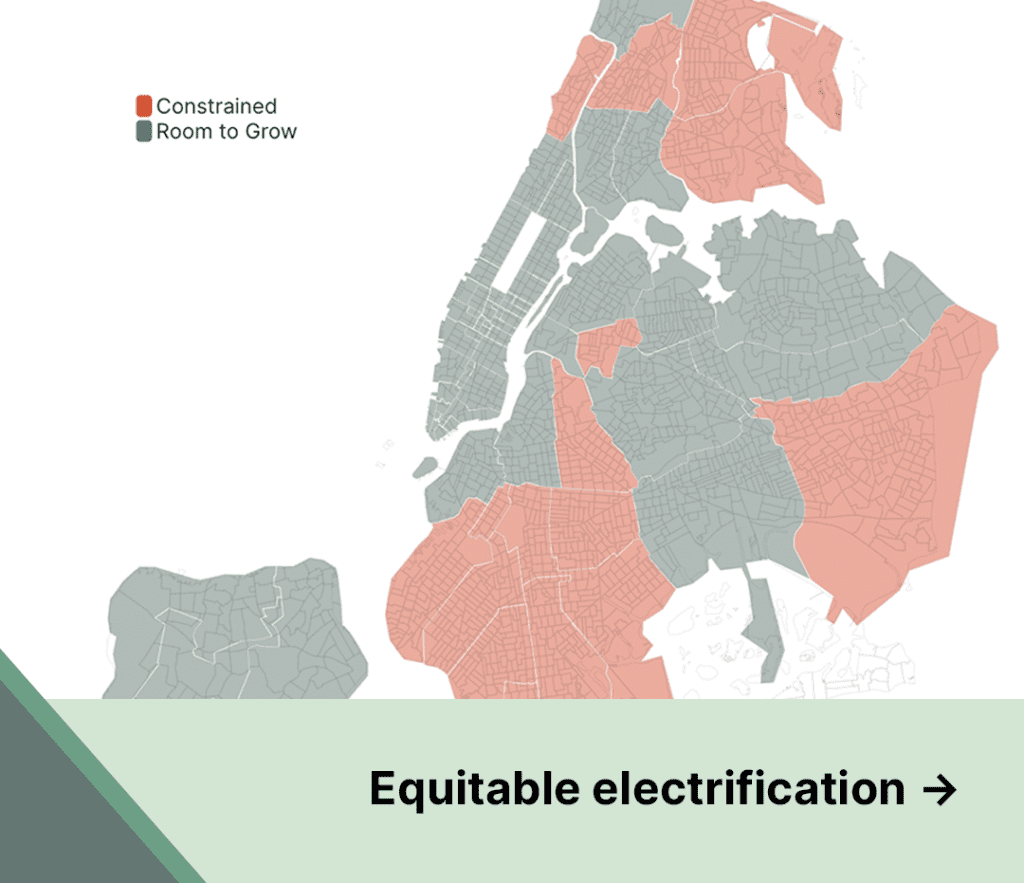

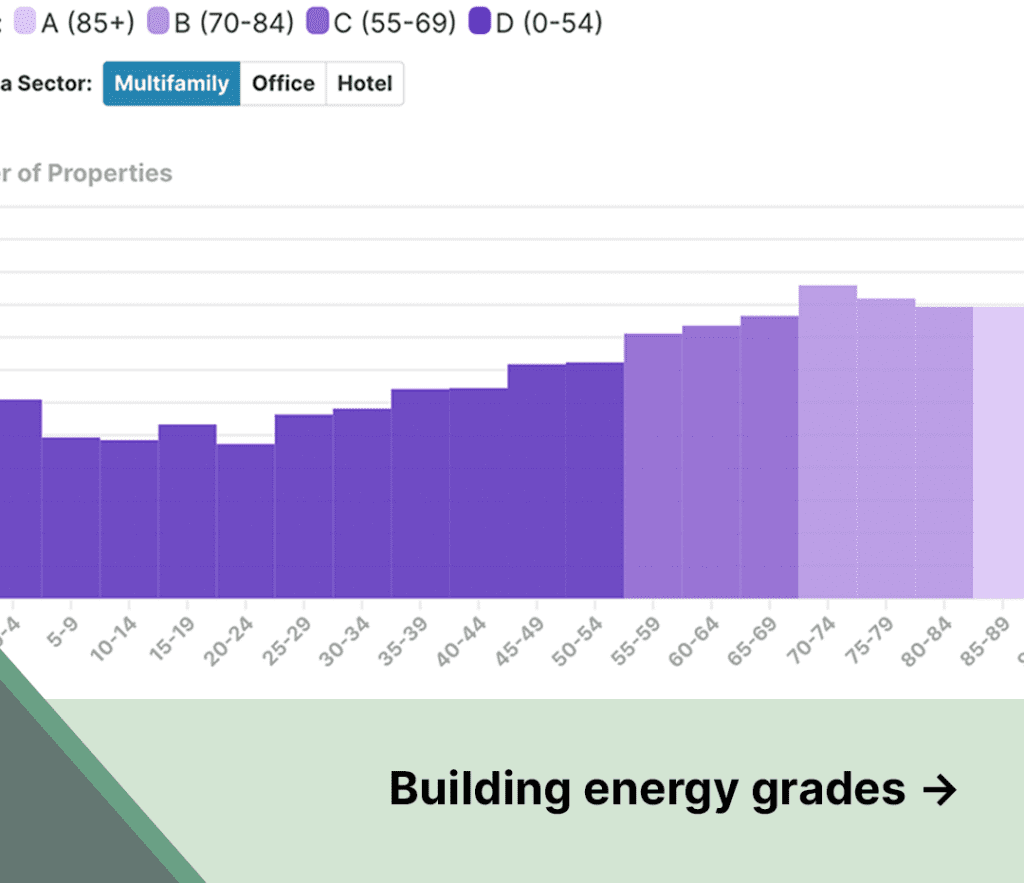

Most buildings in NYC have a mortgage that is held by a bank or financial institution. But historically, these institutions have had limited visibility into the carbon intensity of the buildings in their portfolio. The Decarbonization Compass, a partnership between Urban Green and NYU Stern Center for Sustainable Business, changes this by bringing together NYC’s building energy use and mortgage lienholder data in an interactive data tool.

Banks and publicly traded companies are coming under increasing pressure to measure and disclose their direct and indirect carbon emissions. In 2022, the U.S. Securities and Exchange Commission proposed a new rule requiring all publicly traded companies to report their climate risks and carbon emissions—including “Scope 3 emissions.” For banks, this includes their loans. And in 2023, California passed a law requiring public and private businesses with more than $1 billion annually to report their direct and indirect carbon emissions.

Read our CEO John Mandyck’s article in Harvard Business Review on the potentially transformative impact of this policy development.

This interactive data hub is made possible with generous support from Carrier